Robots do not take root in Russian factories. industrial robot

Industrial robots, automation and robotization of production, Industry 4.0 - we hear and read all these phrases in various variations almost every day. But who in the world today is engaged in the development and production of such machines that are needed in industry? We have compiled an overview of these companies for you.

Of course, there are many more companies - we have identified only the most significant of them, as well as those that are developing industrial robots in Russia and the CIS countries. If you think that we unfairly forgot about someone - write in the comments.

FANUC was founded in 1956 by Seihuemon Inaba, Ph.D., who introduced the concept of numerical control (CNC) from day one. Starting in the late 1950s with the automation of individual pieces of equipment, a few decades later, FANUC was already involved in the automation of entire production lines. And the basis for this innovative growth was the invention of Dr. Inaba: he created the first electric stepper motor, applied numerical control for it, and installed this motor in a machine tool.

Constantly pushing the boundaries of automation, improving product quality and productivity, and cutting costs, Dr. Inaba and his team have designed machine loading robots.

When first-class products such as ROBOCUT, ROBODRILL and ROBOSHOT were introduced into production in the 1970s and 80s, FANUC provided optimized solutions for a variety of applications to meet the requirements of different customers. In Japan, FANUC has become the first company to build and operate an automatic plant with CNC machines and robots.

FANUC, founded 60 years ago, is the world's leading manufacturer of factory automation equipment, with over 3.6 million CNC controllers and 400,000 robots installed worldwide.

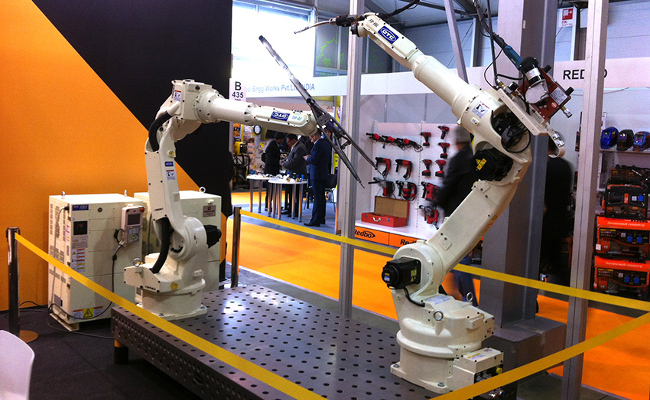

The range of FANUC industrial robots is very wide. The company offers a whole series of robots with different characteristics, capable of performing a wide variety of production tasks: delta robots, robots for painting, welding, palletizing, top-mounting, articulated robots, among which the record holder today in terms of load capacity is 2300 kg! As well as recently introduced collaborative robots that can work side by side with a person.

A Japanese corporation headquartered in the cities of Kobe and Tokyo (Minato), established by Kawasaki Shozo in 1896; one of the world's largest industrial concerns. Initially, the company was engaged in shipbuilding, but at the moment the main products produced are industrial robots, jet skis, tractors, trains, engines, weapons, light aircraft and helicopters, as well as parts for Boeing, Embraer and Bombardier Aerospace aircraft. Kawasaki's products also include motorcycles and ATVs (a division of Consumer Products and Machinery). But we are interested in industrial robots, which the company has been dealing with since 1969.

Kawasaki robots can be used in a variety of areas: assembling small parts weighing only a few grams, moving massive workpieces weighing up to 1.5 tons, various welding methods, painting, palletizing. In addition, Kawasaki's line of robots includes medical and cleanroom robots, as well as a collaborative two-armed robot.

The Yaskawa Electric Group was founded in 1915 and consists of 78 subsidiaries and 21 partnerships with Yaskawa Electric as the parent company. The group has approximately 8,000 employees worldwide and is headquartered in Kitakyushu, Japan. In addition to robotics, YASKAWA also operates in systems development, motion control and information technology and is one of the world's leading manufacturers of servo motors, amplifiers, inverters and controllers for the automation and drive industries, offering both standard products and customized solutions. YASKAWA independently manufactures all major components and technologies for its robots and uses the latest technology in a one-of-a-kind factory in Japan where robots produce robots.

Each year, Yaskawa Electric Corporation produces 1.6 million inverters, 800,000 servo drives and 22,000 MOTOMAN industrial robots, which find their way into a wide variety of industries around the world. To date, more than 270,000 units of MOTOMAN robotics have been installed in the world, including robots for painting, welding, palletizing, loading, working in clean rooms, etc.

NACHI robots are manufactured in Japan by parent company NACHI-Fujikoshi Corp. The main products of NACHI Corporation are electronic equipment, robotic systems, precision machinery, cutting tools, bearings, hydraulic equipment, automotive parts, special steels and coatings. Currently, the NACHI group includes 47 companies, 26 of them are located in Japan, 21 - outside of it. The company's turnover last year exceeded 1 billion 100 million US dollars.

Nachi Fujikoshi is a leading manufacturer of industrial robots that are used by many well-known manufacturers around the world. The line of robots is divided into two: standard, which includes robots of light, medium and heavy classes, as well as for working with a press, and special robots for working in clean rooms.

OTC-DAIHEN Corporation in Osaka (Japan), founded in 1918, occupies a leading position in the world in the production of high-tech welding equipment and robotics. It is not for nothing that 80% of factories in Japan, trusting in the experience and professionalism of OTC-DAIHEN in the field of welding production, have given their preference to cooperation with this company, which is a leader in its field. Among them are such giants of the Japanese industry as Toyota, Mitsubishi, Honda, Mazda, Nissan and others.

Daihen's first generation of OTC arc welding robots was developed in the late 1970s. Since that time, the company has been actively improving and developing the direction of robotic welding and developing a specialized line of robots. OTC Daihen welding robots are used for arc and resistance welding and plasma cutting.

DENSO Corporation was founded in 1949. When the first industrial robots appeared in the 1960s, DENSO began developing and applying new technologies to its own manufacturing processes, allowing it to continuously improve and upgrade hardware and software. The company's first industrial aluminum robot was developed in 1970.

Today, DENSO Robotics is the world leader in small industrial robots and continues to set the tone for reliability, flexibility and functionality. The company has installed more than 60,000 robots worldwide, of which it uses 16,000 in its own production facilities.

Seiko Epson Corporation, better known as Epson, is a division of the Japanese diversified concern Seiko Group. One of the largest manufacturers of inkjet, dot matrix and laser printers, scanners, desktop computers, projectors, and robots for mounting small parts.

Epson robots first appeared on the world market back in 1984. Originally designed to meet the needs of internal automation, Epson's robots have quickly become popular in many well-known manufacturing sites around the world. Over the past 30 years, Epson Robots has become a leader in the small parts assembly robotics industry and has brought many innovations, including PC-based control, compact scara robots, and more. To date, more than 55,000 Epson robots have been installed in factories around the world. Many of the leading manufacturing companies rely on these robots every day to reduce production costs, improve product quality, and increase productivity.

Comau is an Italian multinational company based in Turin and part of the FCA Group. Comau is an integrated industrial automation company with an international network of 35 operating centers, 15 manufacturing plants and 5 innovation centers worldwide. The company offers complete end-to-end solutions, services, products and technologies with competencies ranging from metal cutting to fully robotic manufacturing systems to meet specific manufacturing needs in industries ranging from automotive, rail and heavy industries to renewable energy and other industries.

Comau produces various models of industrial robots with a load capacity of up to 800 kg.

The applicability of Comau robots is standard for any robots with anthropomorphic kinematics: welding technologies, palletizing, machining, application of compositions: painting, primer, adhesives, sealants.

Panasonic is not only a world-famous Japanese engineering corporation with almost a century of history (the company was founded in 1928), which produces household appliances and electronic products, but also one of the market leaders in industrial robotics and welding equipment.

Panasonic Robots is a division of the global Panasonic Corporation, which specializes in the development, production and sale of industrial robots for various purposes. In particular, Panasonic's welding robot is an all-in-one technology, with no additional interface between the robot and the welding source. Today, sales of Panasonic welding robots have reached 40,000 units. The company also produces universal manipulators for many types of production tasks.

Panasonic robots are highly reliable, long service life and relatively low cost. Currently, they are successfully used in the automotive, petrochemical, mechanical engineering, and logistics (cargo handling) industries.

Adept Technology Inc. is a multinational corporation headquartered in California. The company specializes in industrial automation and robotics, including software. Adept was founded in 1983. It all started when company founders Bruce Shimano and Brian Carlyle, both graduate students at Stanford University, started working with Viktor Sheinman at the Stanford Artificial Intelligence Lab.

Today, the company is active in a variety of industries requiring high speed, precision processing, including food processing, consumer goods and electronics, packaging, automotive, medical and laboratory automation, as well as emerging markets such as solar panel manufacturing.

Universal Robots is a Danish manufacturer of small flexible production collaborative robots, the so-called. collaborative. The company was founded in 2005 by three Danish engineers. In the course of joint research, they came to the conclusion that at that time the robotics market was dominated by heavy, expensive and bulky robots. As a consequence, they developed the idea of making robotics accessible to small and medium enterprises. In 2008 the first UR5 cobots were introduced to the Danish and German market. In 2012, the second robot, UR10, was launched. At automatica 2014 in Munich, the company launched a completely revised version of its collaborative robot. A year later, in the spring of 2015, the new UR3 robot was introduced.

BIT Robotics creates new equipment for new technological processes. BIT Robotics is the creator of the first Russian industrial delta robot. The robot created by delta is not inferior to the most modern and high-speed foreign analogues in terms of characteristics. The most advanced materials, including composite ones, are used in its design.

The company's capabilities and competencies allow creating any robotic systems, widely using servo systems and technical vision. The company's engineers have rich experience. Most of them are from the space and aviation industries. The company has the most modern production equipped with CNC machines, a foundry, a galvanizing shop, a production of polymer materials, etc.

- >>

- Last

Industrial robot system

What should you know about industrial robots and their systems? Depends on why you are looking for this information. In this article, we will try to cover the most common questions regarding robots used in an industrial environment.

Not every mechanical device used in an industrial environment can be considered a robot. As defined by ISO (International Organization for Standardization), an industrial robot is an automatically controlled, reprogrammable, multi-purpose arm programmable with three or more axes.

This is a largely accepted definition that is used when talking about industrial robots. However, being a bit of a philosopher, I would like to add a few thoughts to it. As you can read on the home page of this site, the question of what can and cannot be considered a robot is not so simple. Industrial robotics has managed to avoid this confusion until recently.

People like brilliant engineers and entrepreneurs are finding more and more ways how robotics can help streamline workflow in an industrial environment. With advances in battery and wireless technology, the long-established robotic tool should pave the way for newcomers like swarm AGVs (Automated Guided Vehicles) used in warehousing.

Control systems for industrial robots

A typical industrial robot consists of a tool, an industrial robot arm, a control cabinet, a control panel, a training pendant, and other peripheral equipment.

A tool (also called an end effector) is a device designed for a specific task, such as welding or painting. Basically it is a robot that moves the tool. Carefully! It is important to understand that not every industrial robot is like a hand. There are different types of different robot structures.

The control cabinet resembles the brain of a robot. The control panel and the learning pendant make up the user environment. These parts are usually combined.

The control panel is designed to be used by the operator to perform some common tasks. For example, changing programs or managing peripherals. While the training pendant is usually used only during programming, although it can be connected to the control cabinet if additional memory is required to execute the program.

Application of industrial robots

Ideally, the application of industrial robots should be a win-win situation. You know there are jobs that no one wants to do. These are those repetitive, tedious jobs that require a lot of monotonous action on the part of the worker, such as picking something up from one conveyor to another.

If it's always the same task, you can use an automated solution specially designed for your needs. What if it's not? The situation where the factory must be more and more flexible is becoming more and more common. In these cases, a reprogrammable robot that can be used for various tasks may be the right solution.

Also, you should consider a "robot worker" for those tasks that are dangerous for a human worker. For example, surface treatment with hazardous chemicals and work in hazardous environments. In many cases, like the ones mentioned, it is smarter and cheaper in the long run to use a robot than to hire a worker.

And of course, there are jobs that people really need. Like lifting very heavy weights or working in conditions unsuitable for human life. Again, in many of these cases, ad-hoc automated solutions can be applied. However, if flexibility is required, a robot should be considered.

Here is a list of the most commonly seen robot apps:

- arc welding,

- assembly,

- coating,

- deburring,

- Injection molding,

- molding,

- Material handling,

- gathering,

- palletizing,

- package,

- spot welding,

- Transport,

- warehousing.

Structure of industrial robots and manipulators

There are various ways to create a robot. In some cases, it does not resemble a hand at all. In this article, I will cover only the most common types of robot structures that are used in industrial robotics.

So there is:

- Cartesian,

- cylindrical,

- spherical,

- scara,

- articulating shoulder,

- parallel construction.

Why is it important? As you already know (or guessed), each of these types of structures has its own strengths and weaknesses. Some are more accurate, some can lift heavy weights, and some are cheaper.

Namely, you must evaluate what task will be assigned to the robot. At first this may seem silly. You probably already know that you need an arc welding robot, for example. However, you may want to think more deeply.

Maybe there is a possibility of expansion? If yes, perhaps later there may be other or slightly different tasks that can be assigned to the same robot? Maybe the same industrial robotic arm can be used with different tools at different times?

You should consider such opportunities as it can save you (or your employer) a lot of money.

Technical support. Is there a dealer nearby? You will probably need to instruct employees, get software updates, warranty service, etc. The dealer should be located as close to you as possible. The further away your robot dealer is, the longer your downtime will be if maintenance is required, and the higher the cost of staff training.

Of course, there may be exceptions. Perhaps you have a specific task and the only ones that could provide the required robot are far away. Otherwise, you should really choose the robot integrator closest to you.

your factory. You really should not forget to check if all the necessary facilities are available to run a particular robot in your factory. Where will you place it? Are all necessary connections available on the robot's future site? They may include electricity, IO, Ethernet, Serial, etc.

The same thing I mentioned in the challenge part should also be considered when considering technical support and your factory - try to assess future possibilities.

Manufacturers of industrial robots in Russia and in the world

Here is a list of the most prominent manufacturers of industrial robots include:

- Adept Technology,

- Asyst Technologies,

- Brooks Automation,

- DENSO Robotics,

- epson robots,

- FANUC Robotics,

- Intelitek,

- Heavy Industry Kawasaki,

- KUKA Robotics,

- Yaskawa Motoman,

- Nachi Robotic Systems,

- Reis Robotics,

- Toshiba Machine,

- Steubli.

The density of robotization in Russia is almost 70 times lower than the world average, the National Association of Robotics Market Participants (NAURR) found out. If in the world there were on average 69 industrial robots per 10,000 workers in 2015, then in Russia there is only one, according to the NAURR study (see chart). The leader of the ranking is South Korea, where there were 531 industrial robots per 10,000 industrial workers, Singapore (398) and Japan (305). An industrial robot is a programmed manipulator, explains NAURR President Vitaly Nedelsky.

The average annual sales of industrial robots in Russia are 500-600 units (550 were sold in 2015), which is about 0.25% of the global market, according to the NAURR study. By the beginning of 2016, a total of about 8,000 industrial robots were operating in Russia, while there are about 1.6 million of them in the world, follows from the document. The world leader in the number of industrial robots purchased in 2015 is China, whose enterprises purchased 69,000 devices, enterprises of South Korea purchased 38,300, Japan - 35,000. They are followed by the USA and Germany, which purchased 27,000 and 20,105, respectively, last year. robots.

Low demand in Russia is explained by the poor awareness of the technical management of enterprises about the capabilities of robots and the inertia of their thinking, Nedelsky is sure. After all, the purchase of a robot always results in the replacement of workers and updating the technological process. And the fact that most of the large industrial enterprises, which are usually the main consumers of robots, is in state hands, only increases inertia, continues Nedelsky.

There are few technologically advanced industrial enterprises in Russia, explains the low demand, the head of the Skolkovo robotic center, Albert Efimov. At the same time, robots appear at the enterprise almost last, when it has already solved all the problems with energy-saving production, organized labor, he continues. In addition, in Russia, a robot is much more expensive than labor, Efimov believes.

The robot solves a lot of personnel problems of the enterprise, Nedelsky is sure. He is able to work in three shifts, he can turn off the light and stop heating the room. Now the old workers are leaving, but the young ones are not coming in their place, and in the wake of the upcoming shortage of personnel in the industry, the management of enterprises is beginning to show interest in robots, says Nedelsky.

A few years ago, the Agency for Strategic Initiatives (ASI) announced that it would develop a robotization program for the economy, recalls Olga Uskova, President of Cognitive Technologies. However, neither the ASI, nor the Ministry of Industry and Trade or the Ministry of Economics got the program. ASI is not prepared for such work, she believes: since the agency deals with strategic issues, it has a rather complicated and lengthy decision-making procedure, and the issue of robotization of the Russian economy has already gone from the category of strategic and moved to a tactical level, Uskova believes. According to her, this issue should be returned to the sphere of responsibility of the ministries.

According to the NAURR, in the world, robots are mostly employed in the automotive industry (38%), the production of electrical and electronics (25%) and mechanical engineering (12%). In Russia, 40% of robots are also used to create cars.

« Kamaz“Since the beginning of 2015, I have bought 26 robots and brought their total number at the enterprise to a hundred,” says plant representative Oleg Afanasiev. And by 2019, Kamaz will buy another 578 units, he promises. They are needed for the release of a new lineup of "Kamazov", says Afanasiev.

More than 600 robots are now working at the Gorky Automobile Plant of the GAZ group, engaged in stamping, welding, painting and casting, a representative of the enterprise said. 100 of them were purchased in the last two years. At the same time, the economic feasibility of using robots is not the only criterion, he points out, sometimes only a robot can act with the required accuracy and quality, a GAZ representative explains.

From 2005 to 2015, sales of industrial robots in Russia grew annually by 27%, but since 2016, the average sales growth should grow to 50%, NAURR believes. The association attributes the acceleration of growth to the attention from the state, the modernization of the industrial processes of large enterprises and the increased awareness of the technical leaders of companies. There is no own production of industrial robots in Russia, the NAURR report says, but there are four Russian companies engaged in the development of such production. According to Efimov, in 2017 such a development should appear in Skolkovo.

With service robots serving a person in medicine, education, etc., things are much better in Russia, Efimov says. He explains this by the fact that the Russian economy is much closer to the service model than to the industrial one. In addition, service robots are much more demanding on software than industrial robots that perform a limited set of actions. And in Russia they know how to write software, he notes.

Russian manufacturers of industrial robots

, Novosibirsk, Russia

Development, own production and sale of linear robots of own production. Active sales of dozens of robots in 2018-2019. The size of the production area - 1200 sq.m.

Android technology

collaborative robot. Embeddings are unknown.

Aripix Robotics

Six axis robotic arm

, Russia, Kazan

Developer and manufacturer of 3-7 axis industrial robots ARKODIM of console type, linear architecture. In 2016, there are a number of sales and implementations in commercial practice.

(Bitrobotics, LLC "Bitrobotics"), Russia

Bitrobotics is a manufacturer of robotic systems based on robots of its own design and production. The company aims to automate the technological processes of production, stacking and packaging of consumer goods. The Bitrobotics robotics platform allows you to quickly assemble a solution from unified elements.

Bitrobotics is a resident of the SEZ "Technopolis "Moscow" and in the 3rd quarter of 2020 will put into operation a new high-tech production.

VMZ (LLC "VMZ", Volzhsky Machine-Building Plant), Russia

Developer and manufacturer of industrial robots. The company has been operating since 2011. For 2016 - in the stage of liquidation of this direction. The closure at the VAZ is associated with the lack of orders for robots.

NIIP-NZiK (NPO NIIP-NZiK, Comintern), Russia, Novosibirsk

plans for the creation of industrial robots to equip injection molding machines. There is no production for 2018. Robots are not of their own design, this is an attempt to localize Chinese robots.

Six axis robotic arm.

Record Engineering (Record-Engineering LLC), Russia, Yekaterinburg

Design and production of industrial robotic manipulators, production of analogues of imported industrial robotic manipulators. There are sales.

http://www.rekord-eng.com/avtomatizaciya/promyshlenennye_roboty/

see Aripix Robotics

BID Technologies

Eidos Robotics (Eidos Medicine)

see Eidos-Robotics

See AvangardPLAST

Robotech Systems

See Robotech Systems

ROZUM Robotics, Belarus

Development of collaborative robots.

Saga Robotics (ProDivision)

Six-axis robot used for robotic welding

Foreign manufacturers of industrial robots

Represented in Russia

- , Switzerland

- Bosch

- Comau

- Epson, Japan

- , Japan

- HIWIN, Taiwan

- igm Robotersystems AG, Austria

- , Japan

- , China (originally - Germany)

- Mitsubishi Electric, Japan

- Omron, Japan

- OTC (Daihen Inc.)

- Panasonic, Japan

- , Denmark

- , Japan

The largest and most visible in the world market

Electroimpact, USA (giant AFP machines for 3D printing from composite materials)

Epson, Japan

Developer-manufacturers of industrial robots of various types. SCARA, 6-axis.

Product examples: LS3-B; LS6-B, LS10-B, LS20-B; VT6L.

Developer and manufacturer of collaborative industrial robots. Notable models are Baxter first and second generations.

Sepro Group, France

The largest manufacturer of industrial robotics in France - Sepro Group. In May 2017, the company announced a decision to expand its business in France and the United States. Planned investments - $11 million euros. The area of the head office in La Roche-sur-Yon, France will grow to 20,000 sq. m. m, a training center will open nearby. Commissioning is scheduled for summer 2018. In the US, the Warrendale facility will be expanded, with robot assembly starting in 4Q2017. The company's sales volume of robots has been growing for the past four years - from 1.3 thousand in 2012 to more than 2.7 thousand in 2017. Company website: http://www.sepro-group.com/products_archive/

Developer and manufacturer of industrial robots and components for their production.

Xinsong, China

Located in Shenyang, Liaoning Province. Designing and manufacturing industrial robots since 1993. In 2001, the company's sales volume of robots was 100 million yuan. In 2011, the company accounted for up to a third of the Chinese robot market. It also produces mobile industrial robots, which are in demand not only in China, but also, for example, in the USA and Canada.

Alisa Konyukhovskaya - [email protected]

The global industrial robotics market shows a high growth rate. Which regions and countries are world market leaders? Which industries show the greatest demand? At what level of development is the Russian market of industrial robotics? What are the restrictions on the development of the Russian market? The answers to all these questions are presented in this article.

Since 2010, the demand for industrial robots has increased significantly due to the trend of factory automation and technical improvements in industrial robots. Between 2010 and 2014 the average growth of their sales was 17% per year: between 2005 and 2008. about 115 thousand pieces were sold on average. robots, while between 2010 and 2014. the average sales volume increased to 171 thousand units. (Fig. 1). The increase in shipments was approximately 48%, which is a sign of a significant increase in demand for industrial robots around the world. In 2015, more than 250,000 robots were already sold, which was a new record for the market, which grew by 8% in a year. The greatest demand was registered in the automotive industry.

Regions

Asia(including Australia and New Zealand) is the largest market with about 139,300 industrial robots sold in 2014, up 41% from 2013. In 2015, over 144,000 industrial robots were sold in Asia.

Europe– the second largest market, where sales in 2014 increased by 5%, i.е. up to 45,000 pcs. In 2015, sales in Europe grew by 9% to reach 50,000 units. The most rapid growth in 2015 was demonstrated by the market of Eastern Europe – by 29%.

North America– the third market in terms of sales: in 2014, 32,600 units were sold, which is 8% more than in 2013, and in 2015, 34,000 units were sold, which was a new record for the region. In the first quarter of 2016, 7,125 robots were sold in the region for $448 million. North American companies also ordered 7,406 robots for a total value of about $402 million, up 7% from orders in the same period last year.

Leading countries

China is the largest industrial robot market and the fastest growing market in the world. In 2014, 57,096 industrial robots were sold, which is 56% more than in 2013. Of these, about 16,000 robots were installed by Chinese suppliers, according to the China Robot Industry Alliance (CRIA). Sales were 78% higher than in 2013. This is partly due to an increase in the number of companies that provided their sales data for the first time in 2014. Foreign suppliers of industrial robots in China increased their sales by 49% , i.e. up to 41,100 units, including robots made by international manufacturers in China. Between 2010 and 2014 total shipments of industrial robots increased by an average of about 40% per year, and in 2015, China continued to show the highest growth, sales reached 66,000 units, and the market grew by 16%. This rapid development is a unique record in the history of robotics. In a wide variety of industries in China, there is increasing investment in factory automation.

AT Japan in 2014, 29,300 industrial robots were sold, the market grew by 17%. Since 2013, Japan has become the second largest market in terms of annual sales. Robot sales in Japan tended to decline from 2005, when sales peaked at 44,000 robots, until 2009, when sales fell to 12,800 units. Between 2010 and 2014 sales increased by an average of 8% per year.

Industrial robot market USA, the third largest in the world, increased by 11% in 2014, reaching a peak of 26,200 units. The driver of this growth is the trend towards production automation in order to strengthen the position? American industry in the world market and maintaining production in the home region, and in some cases with the aim of returning production from other regions.

Sales in Republic of Korea in 2014 increased by 16% to 24,700 units, slightly falling short of the 2011 record of 26,536 units. As in 2013, purchases of industrial robots from suppliers of automotive components (in particular, in the production of electrical components, such as batteries? etc.) increased significantly, while almost all other industries in 2014 bought significantly fewer robots. During 2010-2014 the annual sales of robots in the Republic of Korea has been more or less stable.

Germany is the fifth largest industrial robot market. In 2014, sales of robots increased by 10% to 20,100 units, which was a sales record. Deliveries of robots to Germany increased in 2010-2014. by an average of 9%, despite the high density of robots in the country. The main driver of sales growth in Germany was the automotive industry.

Since 2013 Taiwan ranks sixth among the most important industrial robot markets in the world in terms of annual deliveries to the country. The installation of robotic systems increased significantly between 2010-2014. - an average of 20% per year. In 2014, robot sales increased by 27% to 6,900 units. However, the number of installed robots in Taiwan is significantly lower than Germany, which ranks fifth with 20,100 units.

Italy is the second largest market for industrial robots in Europe after Germany and ranks 7th in the global ranking for the supply of industrial robots. Sales in it increased by 32% to 6,200 units in 2014. This is the second such high level of annual sales since 2001, which is a clear sign of the recovery of the Italian economy. Between 2010 and 2013 annual sales in Italy were rather weak due to the crisis situation in the country.

Thailand is also a growing industrial robot market in Asia, ranking 8th in 2014 among other markets. 3,700 robots were installed - only 2% of the total global shipments.

AT India about 2,100 industrial robots were sold in 2014, a new peak for the country. Deliveries of robots to other South Asian countries (Indonesia, Malaysia, Vietnam, Singapore, etc.) increased in 2014: 10,140 units in 2014 compared to 661 units in 2013.

In France the market of industrial robots also recovered - 3,000 units (+36%). AT Spain sales of industrial robots decreased by 16% to 2,300 units. After a significant investment? between 2011 and 2013 sales in the automotive industry have declined markedly, although other industries have continued to increase investment in robotics. Sales of industrial robots in Great Britain dropped to 2,100 units in 2014 after significant investment? in the automotive industry in 2011-2012.

Demand for industrial robots by industry

The main "catalysts" for the growth of global sales of industrial robots are the automotive industry and electrical / electronics.

Since 2010, the automotive industry has been the most important customer of industrial robot manufacturers, significantly increasing investment in industrial robots around the world. In 2014, a new sales peak was recorded: about 98,000 new robots were installed in enterprises, which is 43% more than in 2013. The share of the automotive industry in the total number of deliveries of industrial robots is approximately 43%. Between 2010 and 2014 sales of robots in the automotive industry increased by an average of 27% per year. Investments in new manufacturing facilities in emerging markets and investments in manufacturing upgrades in major automotive manufacturing countries have boosted sales of robotics. In 2014, most of the robots were sold to manufacturers of automotive electronics components for the production of batteries and other electronic parts in cars.

Sales of robots for the production of electrical and electronics (including computers, equipment, radios, televisions, communication devices, etc.) increased significantly in 2014 and grew by 34% to 48,400 units. The share of the total supply is about 21%. Growing demand for electronics and new products, as well as the need to automate manufacturing, have been driving factors for accelerating demand.

Sales across all industries except automotive and electronics/electrics increased 21% in 2014. Between 2010 and 2014, the average idle rate was 17%. The sales growth rate for the automotive industry during this period was 27% and for the electrical/electronics industry 11%. This is a clear sign that the number of sales has increased not only in areas that are the main consumers of industrial robots (automotive and electrical and electronics), but also in other industries. Robot vendors report that the number of customers has shown significant growth in recent years. Although the number of robots ordered by the client is often very small.

Density of robotization

In many countries, there is a high potential for the use of industrial robots. Comparisons across countries of quantitative indicators, such as the total number of robotics units on the market, can be misleading. In order to take into account differences in the scale of the manufacturing industry, it is preferable to use an indicator of robot density. This density is expressed as the number of multifunctional robots per 10,000 workers employed in the manufacturing, automotive, or industry as a whole, which includes all industries except automotive.

The approximate global robot density is 66 industrial robots installed per 10,000 manufacturing workers (Figure 2). The factories with the highest level of robotization are the factories in the Republic of Korea, Japan and Germany. By continuing to expand the installation of robots over the past few years, in 2014, the Republic of Korea ranked first in terms of robot density (478 industrial robots per 10,000 workers). The density of robots in Japan continues to decrease: in 2014 it reached 314 units. In Germany, the reverse trend is observed: the density of robots has increased to 292 units. The United States of America is one of the top five global markets for robotic manufacturing, with a density in the US in 2014 of 164 machines per 10,000 workers. China, the largest robotics market in the world since 2013, has reached 36 units per 10,000 workers, demonstrating high potential for further robot installations in this country.

In 2014, the density of robotization in the manufacturing industry by region was: 85 in Europe, 79 in America, 54 in Asia (Fig. 3).

The density of robotization in the automotive industry is higher. Despite an overall decline in robot density, Japan currently has the highest robot density in the automotive industry (1,414 units installed per 10,000 workers). This is followed by Germany (1,149 vehicles per 10,000 workers), the United States of America (1,141 vehicles per 10,000 workers) and the Republic of Korea (1,129 vehicles per 10,000 workers).

Since 2007, the density of robotics in the automotive industry in China has increased significantly (305 units), but it is still at an average level. The reason for this is the large number of workers involved in this area. According to the China Statistical Yearbook, as of 2013, the automotive industry employed about 3.4 million people (including the production of auto parts). In 2014, about 20 million cars were produced in China, which was a record for the country and accounted for approximately 30% of all cars produced in the world. The necessary modernization and further increase in capacity will significantly increase the installation of robots in the coming years: the potential for installation of robotics in this market is still huge.

Russia

In Russia, sales of robots are extremely low - about 500-600 robots per year, the density of robotization is about 2 robots per 10,000 workers. In addition to the really low level of use of RTK in production, these figures are also due to the difficulty of obtaining data on the market, which is fragmented and, until recently, has not been purposefully studied. In 2015, the National Association of Robotics Market Participants (NAURR) was formed, which, in addition to the general tasks of market development, collects statistics and creates analytical materials on the robotics market.

The total number of industrial robots installed by 2015 in the Russian Federation is about 2,740 pieces. (Fig. 4). From 2010 to 2013, there was a steady growth in sales of industrial robots - an average of about 20% per year. In 2013, sales peaked at 615 robots (a 34% increase over 2012), but in 2014, sales dropped sharply by 56% to around 340 robots. The reason for this is a strong change in the exchange rate.

Preliminary sales figures for 2015 are about 550 robots. The leaders of the Russian industrial robotics market are KUKA and FANUC, which occupy about 90% of the market.

There are very few domestic manufacturers of industrial robots in Russia. In 2015, the Volzhsky Machine-Building Plant was closed, which for a long time was the only manufacturer of industrial robots in the country. In 2016, it is planned to launch a new plant for the production of industrial robots in Bashkiria. The Russian companies Record-Engineering, BIT-Robotics, Eidos-Robotics develop industrial robots, but their sales volume is still unknown.

In addition to manufacturers of industrial robots, important market players are system integrators who integrate the robot into the technological process. The cost of the robot itself can be about 50% of the price of a solution that requires specialized equipment, software settings, services, etc. There are about 50 integrator companies in Russia, which differ in their area of specialization and size.

One of the reasons for the low level of development of the industrial robotics market is the low awareness of enterprises about the possibilities of robotization of production processes and the associated cost reduction. Integrators almost do not calculate the real payback of RTK after installation, leaving it at the mercy of enterprises. It is possible to stimulate the development of industrial robotics in the country through the dissemination of systematized information on the real payback of RTK by industry and operations.

To study various barriers to the development of robotics (both industrial and service), the National Association of Robotics Market Participants in December 2015 conducted a survey of Russian robotics companies. Respondents' answers to the question about the restrictions that hinder the development of robotics in the Russian Federation, about the existing risks and barriers in the robotics market in general, are structured in the table into the groups "Education and Culture", "Technology", "Economy", "State", "Science" ".

| Group | The reasons |

| Education and culture |

|

| Technology |

|

| Economy |

|

| State |

|

| The science |

|

Overcoming the existing restrictions, of course, is impossible by the measures of one state; in order to form an industry development strategy, a broad dialogue of all market participants is necessary.

Thus, the global robotics market shows high growth rates (about 8%). The world leaders in the use of RTK in industry are China, Japan, South Korea, the USA and Germany. Russia, on the other hand, lags far behind in robotization of production for a number of reasons, which can only be overcome through communication and consolidation of participants in the robotics market.